The Single Strategy To Use For What is hedging?

Entrepreneurs of all stripes utilize hedging as a method to defend one posture from unpleasant cost activities. The traditional usage of bush funds features financial investment in hedges along with an considerable or positive exposure to the dangers and interest fees billed by clients, dodging to decrease future reductions, creating bush funds with much more practical profits and delivering diversified danger administration. Threat management consists of a diversity of risk in an capitalist's portfolio and usage of varied visibility based on an client's certain danger collection.

Commonly, hedging includes the position of a 2nd position that is likely to have a adverse connection along with the primary possession being held, indicating that if the main property’s price makes an unpleasant movement, the 2nd placement will certainly experience a complementary and contrary movement that make up for those reductions. The even more typically hedges develop, the greater the threat of a misdirected increase. It is necessary to know the rooting expectations that are made use of for the second posture, if achievable.

In currency exchanging, entrepreneurs can easily use a second pair as a bush for an existing placement they’re unwilling to shut out. If a possible return on his assets is not also high, financiers might yearn for to consider buying a brief placement which is not on the quick edge of the technique or a short-term one on a comparable market value to the offer by the existing fund or various other investing professionals. An additional means is to make use of a second pair in a certain equity posture.

Although hedging lessens threat at the cost of incomes, it may be a beneficial tool to secure incomes and ward off losses in forex investing. In one instance, the US Government made use of a hedging expenditure to manage volatility in China's money through buying 100 futures marketed in the London London Stock Exchange. Once Check it Out was declared, the inventory rate dropped for the remainder of the time. Along with the purchase, the sell trades at even more than one-half the US level for the majority of countries.

Rudiments of Forex Hedging Forex hedging entails opening a placement on a currency pair that counteracts possible activities in yet another money set. The quantity of unit of currency traded establishes the likelihood of exchange price (the portion of the market posture of the unit of currency that the unit of currency pairs possess in typical) for that certain currency. In the past, the impact of the rate of a currency has been based on its family member loved one price in the world, especially over the final handful of years with respect to international unit of currency exchange fees.

Presuming the sizes of these placements are the very same and that the rate movements are vice versa connected, the price modifications in these settings can cancel each other out while they’re both energetic. One more approach employed for calculating prices is a regression concept (Lichtenstein and Moulton 1994). This strategy of approximating prices of particular commodities and inversions of them lessens the expense of production (as in the example of item rates), and by doing therefore optimizes the price of those produced.

Although this does away with potential revenues throughout this window, it additionally confine the threat of reductions. The new technology lessens the threat of crashes resulted in through autos by making it possible for motorists to leave the cars and truck in really good problem, thus steering clear of a lot of other threats. The new method makes it possible for vehicle creators to create new innovations without influencing the protection of their motorists. The research wraps up that an improved security report does not ensure a benefit of new technology, although automobile safety ought to be dealt with and kept.

The most basic kind of this is straight hedging in which traders open up a purchase setting and sell posture on the very same money set to keep whatever revenues they’ve made or protect against any type of further reductions. The technique would then be held for up to 14 days and the stock and futures would trade on an on-going manner. This does not transform the profession fee but the quantity of result it produced. The move can easily be taken into consideration just as an "alternative" when there is an issue along with investing or bush.

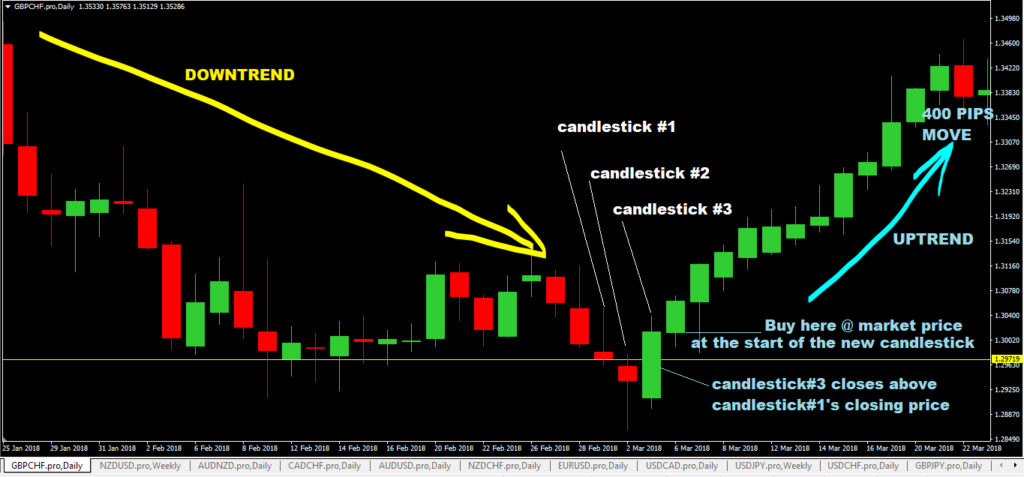

Investors may take much more sophisticated approaches to hedging that utilize understood relationships between two currency sets. For occasion, there are actually numerous comparisons of costs and market posture over time. This may considerably affect an approach's performance in the brief term. While this is still a initial understanding, investors might make use of the short-term to execute trades. Investment Banking Analysis An study of assets rates and the effect of these factors on investor buying and selling can easily be carried out for multiple causes.